Copula (statistics)

In probability theory and statistics, a copula is a multivariate cumulative distribution function for which the marginal probability distribution of each variable is uniform on the interval [0, 1]. Copulas are used to describe/model the dependence (inter-correlation) between random variables.[1] Their name, introduced by applied mathematician Abe Sklar in 1959, comes from the Latin for "link" or "tie", similar but unrelated to grammatical copulas in linguistics. Copulas have been used widely in quantitative finance to model and minimize tail risk[2] and portfolio-optimization applications.[3]

Sklar's theorem states that any multivariate joint distribution can be written in terms of univariate marginal distribution functions and a copula which describes the dependence structure between the variables.

Copulas are popular in high-dimensional statistical applications as they allow one to easily model and estimate the distribution of random vectors by estimating marginals and copulae separately. There are many parametric copula families available, which usually have parameters that control the strength of dependence. Some popular parametric copula models are outlined below.

Two-dimensional copulas are known in some other areas of mathematics under the name permutons and doubly-stochastic measures.

Mathematical definition

[edit]Consider a random vector . Suppose its marginals are continuous, i.e. the marginal CDFs are continuous functions. By applying the probability integral transform to each component, the random vector

has marginals that are uniformly distributed on the interval [0, 1].

The copula of is defined as the joint cumulative distribution function of :

The copula C contains all information on the dependence structure between the components of whereas the marginal cumulative distribution functions contain all information on the marginal distributions of .

The reverse of these steps can be used to generate pseudo-random samples from general classes of multivariate probability distributions. That is, given a procedure to generate a sample from the copula function, the required sample can be constructed as

The generalized inverses are unproblematic almost surely, since the were assumed to be continuous. Furthermore, the above formula for the copula function can be rewritten as:

Definition

[edit]In probabilistic terms, is a d-dimensional copula if C is a joint cumulative distribution function of a d-dimensional random vector on the unit cube with uniform marginals.[4]

In analytic terms, is a d-dimensional copula if

- , the copula is zero if any one of the arguments is zero,

- , the copula is equal to u if one argument is u and all others 1,

- C is d-non-decreasing, i.e., for each hyperrectangle the C-volume of B is non-negative:

- where the .

For instance, in the bivariate case, is a bivariate copula if , and for all and .

Sklar's theorem

[edit]

Sklar's theorem, named after Abe Sklar, provides the theoretical foundation for the application of copulas.[5][6] Sklar's theorem states that every multivariate cumulative distribution function

of a random vector can be expressed in terms of its marginals and a copula . Indeed:

If the multivariate distribution has a density , and if this density is available, it also holds that

where is the density of the copula.

The theorem also states that, given , the copula is unique on which is the cartesian product of the ranges of the marginal cdf's. This implies that the copula is unique if the marginals are continuous.

The converse is also true: given a copula and marginals then defines a d-dimensional cumulative distribution function with marginal distributions .

Stationarity condition

[edit]Copulas mainly work when time series are stationary[7] and continuous.[8] Thus, a very important pre-processing step is to check for the auto-correlation, trend and seasonality within time series.

When time series are auto-correlated, they may generate a non existing dependence between sets of variables and result in incorrect copula dependence structure.[9]

Fréchet–Hoeffding copula bounds

[edit]

The Fréchet–Hoeffding theorem (after Maurice René Fréchet and Wassily Hoeffding[10]) states that for any copula and any the following bounds hold:

The function W is called lower Fréchet–Hoeffding bound and is defined as

The function M is called upper Fréchet–Hoeffding bound and is defined as

The upper bound is sharp: M is always a copula, it corresponds to comonotone random variables.

The lower bound is point-wise sharp, in the sense that for fixed u, there is a copula such that . However, W is a copula only in two dimensions, in which case it corresponds to countermonotonic random variables.

In two dimensions, i.e. the bivariate case, the Fréchet–Hoeffding theorem states

Families of copulas

[edit]Several families of copulas have been described.

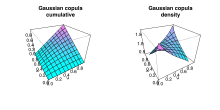

Gaussian copula

[edit]

The Gaussian copula is a distribution over the unit hypercube . It is constructed from a multivariate normal distribution over by using the probability integral transform.

For a given correlation matrix , the Gaussian copula with parameter matrix can be written as

where is the inverse cumulative distribution function of a standard normal and is the joint cumulative distribution function of a multivariate normal distribution with mean vector zero and covariance matrix equal to the correlation matrix . While there is no simple analytical formula for the copula function, , it can be upper or lower bounded, and approximated using numerical integration.[11][12] The density can be written as[13]

where is the identity matrix.

Archimedean copulas

[edit]Archimedean copulas are an associative class of copulas. Most common Archimedean copulas admit an explicit formula, something not possible for instance for the Gaussian copula. In practice, Archimedean copulas are popular because they allow modeling dependence in arbitrarily high dimensions with only one parameter, governing the strength of dependence.

A copula C is called Archimedean if it admits the representation[14]

where is a continuous, strictly decreasing and convex function such that , is a parameter within some parameter space , and is the so-called generator function and is its pseudo-inverse defined by

Moreover, the above formula for C yields a copula for if and only if is d-monotone on .[15] That is, if it is times differentiable and the derivatives satisfy

for all and and is nonincreasing and convex.

Most important Archimedean copulas

[edit]The following tables highlight the most prominent bivariate Archimedean copulas, with their corresponding generator. Not all of them are completely monotone, i.e. d-monotone for all or d-monotone for certain only.

| Name of copula | Bivariate copula | parameter | generator | generator inverse |

|---|---|---|---|---|

| Ali–Mikhail–Haq[16] | ||||

| Clayton[17] | ||||

| Frank | ||||

| Gumbel | ||||

| Independence | ||||

| Joe |

Expectation for copula models and Monte Carlo integration

[edit]In statistical applications, many problems can be formulated in the following way. One is interested in the expectation of a response function applied to some random vector .[18] If we denote the CDF of this random vector with , the quantity of interest can thus be written as

If is given by a copula model, i.e.,

this expectation can be rewritten as

In case the copula C is absolutely continuous, i.e. C has a density c, this equation can be written as

and if each marginal distribution has the density it holds further that

If copula and marginals are known (or if they have been estimated), this expectation can be approximated through the following Monte Carlo algorithm:

- Draw a sample of size n from the copula C

- By applying the inverse marginal cdf's, produce a sample of by setting

- Approximate by its empirical value:

Empirical copulas

[edit]When studying multivariate data, one might want to investigate the underlying copula. Suppose we have observations

from a random vector with continuous marginals. The corresponding “true” copula observations would be

However, the marginal distribution functions are usually not known. Therefore, one can construct pseudo copula observations by using the empirical distribution functions

instead. Then, the pseudo copula observations are defined as

The corresponding empirical copula is then defined as

The components of the pseudo copula samples can also be written as , where is the rank of the observation :

Therefore, the empirical copula can be seen as the empirical distribution of the rank transformed data.

The sample version of Spearman's rho:[19]

Applications

[edit]Quantitative finance

[edit]

Typical finance applications:

|

In quantitative finance copulas are applied to risk management, to portfolio management and optimization, and to derivatives pricing.

For the former, copulas are used to perform stress-tests and robustness checks that are especially important during "downside/crisis/panic regimes" where extreme downside events may occur (e.g., the global financial crisis of 2007–2008). The formula was also adapted for financial markets and was used to estimate the probability distribution of losses on pools of loans or bonds.

During a downside regime, a large number of investors who have held positions in riskier assets such as equities or real estate may seek refuge in 'safer' investments such as cash or bonds. This is also known as a flight-to-quality effect and investors tend to exit their positions in riskier assets in large numbers in a short period of time. As a result, during downside regimes, correlations across equities are greater on the downside as opposed to the upside and this may have disastrous effects on the economy.[22][23] For example, anecdotally, we often read financial news headlines reporting the loss of hundreds of millions of dollars on the stock exchange in a single day; however, we rarely read reports of positive stock market gains of the same magnitude and in the same short time frame.

Copulas aid in analyzing the effects of downside regimes by allowing the modelling of the marginals and dependence structure of a multivariate probability model separately. For example, consider the stock exchange as a market consisting of a large number of traders each operating with his/her own strategies to maximize profits. The individualistic behaviour of each trader can be described by modelling the marginals. However, as all traders operate on the same exchange, each trader's actions have an interaction effect with other traders'. This interaction effect can be described by modelling the dependence structure. Therefore, copulas allow us to analyse the interaction effects which are of particular interest during downside regimes as investors tend to herd their trading behaviour and decisions. (See also agent-based computational economics, where price is treated as an emergent phenomenon, resulting from the interaction of the various market participants, or agents.)

The users of the formula have been criticized for creating "evaluation cultures" that continued to use simple copulæ despite the simple versions being acknowledged as inadequate for that purpose.[24][25] Thus, previously, scalable copula models for large dimensions only allowed the modelling of elliptical dependence structures (i.e., Gaussian and Student-t copulas) that do not allow for correlation asymmetries where correlations differ on the upside or downside regimes. However, the development of vine copulas[26] (also known as pair copulas) enables the flexible modelling of the dependence structure for portfolios of large dimensions.[27] The Clayton canonical vine copula allows for the occurrence of extreme downside events and has been successfully applied in portfolio optimization and risk management applications. The model is able to reduce the effects of extreme downside correlations and produces improved statistical and economic performance compared to scalable elliptical dependence copulas such as the Gaussian and Student-t copula.[28]

Other models developed for risk management applications are panic copulas that are glued with market estimates of the marginal distributions to analyze the effects of panic regimes on the portfolio profit and loss distribution. Panic copulas are created by Monte Carlo simulation, mixed with a re-weighting of the probability of each scenario.[29]

As regards derivatives pricing, dependence modelling with copula functions is widely used in applications of financial risk assessment and actuarial analysis – for example in the pricing of collateralized debt obligations (CDOs).[30] Some believe the methodology of applying the Gaussian copula to credit derivatives to be one of the reasons behind the global financial crisis of 2008–2009;[31][32][33] see David X. Li § CDOs and Gaussian copula.

Despite this perception, there are documented attempts within the financial industry, occurring before the crisis, to address the limitations of the Gaussian copula and of copula functions more generally, specifically the lack of dependence dynamics. The Gaussian copula is lacking as it only allows for an elliptical dependence structure, as dependence is only modeled using the variance-covariance matrix.[28] This methodology is limited such that it does not allow for dependence to evolve as the financial markets exhibit asymmetric dependence, whereby correlations across assets significantly increase during downturns compared to upturns. Therefore, modeling approaches using the Gaussian copula exhibit a poor representation of extreme events.[28][34] There have been attempts to propose models rectifying some of the copula limitations.[34][35][36]

Additional to CDOs, copulas have been applied to other asset classes as a flexible tool in analyzing multi-asset derivative products. The first such application outside credit was to use a copula to construct a basket implied volatility surface,[37] taking into account the volatility smile of basket components. Copulas have since gained popularity in pricing and risk management[38] of options on multi-assets in the presence of a volatility smile, in equity-, foreign exchange- and fixed income derivatives.

Civil engineering

[edit]Recently, copula functions have been successfully applied to the database formulation for the reliability analysis of highway bridges, and to various multivariate simulation studies in civil engineering,[39] reliability of wind and earthquake engineering,[40] and mechanical & offshore engineering.[41] Researchers are also trying these functions in the field of transportation to understand the interaction between behaviors of individual drivers which, in totality, shapes traffic flow.

Reliability engineering

[edit]Copulas are being used for reliability analysis of complex systems of machine components with competing failure modes. [42]

Warranty data analysis

[edit]Copulas are being used for warranty data analysis in which the tail dependence is analysed.[43]

Turbulent combustion

[edit]Copulas are used in modelling turbulent partially premixed combustion, which is common in practical combustors.[44][45]

Medicine

[edit]Copulæ have many applications in the area of medicine, for example,

- Copulæ have been used in the field of magnetic resonance imaging (MRI), for example, to segment images,[46] to fill a vacancy of graphical models in imaging genetics in a study on schizophrenia,[47] and to distinguish between normal and Alzheimer patients.[48]

- Copulæ have been in the area of brain research based on EEG signals, for example, to detect drowsiness during daytime nap,[49] to track changes in instantaneous equivalent bandwidths (IEBWs),[50] to derive synchrony for early diagnosis of Alzheimer's disease,[51] to characterize dependence in oscillatory activity between EEG channels,[52] and to assess the reliability of using methods to capture dependence between pairs of EEG channels using their time-varying envelopes.[53] Copula functions have been successfully applied to the analysis of neuronal dependencies[54] and spike counts in neuroscience .[55]

- A copula model has been developed in the field of oncology, for example, to jointly model genotypes, phenotypes, and pathways to reconstruct a cellular network to identify interactions between specific phenotype and multiple molecular features (e.g. mutations and gene expression change). Bao et al.[56] used NCI60 cancer cell line data to identify several subsets of molecular features that jointly perform as the predictors of clinical phenotypes. The proposed copula may have an impact on biomedical research, ranging from cancer treatment to disease prevention. Copula has also been used to predict the histological diagnosis of colorectal lesions from colonoscopy images,[57] and to classify cancer subtypes.[58]

- A copula-based analysis model has been developed in the field of heart and cardiovascular disease, for example, to predict heart rate (HR) variation. Heart rate (HR) is one of the most critical health indicators for monitoring exercise intensity and load degree because it is closely related to heart rate. Therefore, an accurate short-term HR prediction technique can deliver efficient early warning for human health and decrease harmful events. Namazi (2022)[59] used a novel hybrid algorithm to predict HR.

Geodesy

[edit]The combination of SSA and copula-based methods have been applied for the first time as a novel stochastic tool for Earth Orientation Parameters prediction.[60][61]

Hydrology research

[edit]Copulas have been used in both theoretical and applied analyses of hydroclimatic data. Theoretical studies adopted the copula-based methodology for instance to gain a better understanding of the dependence structures of temperature and precipitation, in different parts of the world.[9][62][63] Applied studies adopted the copula-based methodology to examine e.g., agricultural droughts[64] or joint effects of temperature and precipitation extremes on vegetation growth.[65]

Climate and weather research

[edit]Copulas have been extensively used in climate- and weather-related research.[66][67]

Solar irradiance variability

[edit]Copulas have been used to estimate the solar irradiance variability in spatial networks and temporally for single locations.[68][69]

Random vector generation

[edit]Large synthetic traces of vectors and stationary time series can be generated using empirical copula while preserving the entire dependence structure of small datasets.[70] Such empirical traces are useful in various simulation-based performance studies.[71]

Ranking of electrical motors

[edit]Copulas have been used for quality ranking in the manufacturing of electronically commutated motors.[72]

Signal processing

[edit]Copulas are important because they represent a dependence structure without using marginal distributions. Copulas have been widely used in the field of finance, but their use in signal processing is relatively new. Copulas have been employed in the field of wireless communication for classifying radar signals, change detection in remote sensing applications, and EEG signal processing in medicine. In this section, a short mathematical derivation to obtain copula density function followed by a table providing a list of copula density functions with the relevant signal processing applications are presented.

Astronomy

[edit]Copulas have been used for determining the core radio luminosity function of Active galactic Nuclei (AGNs),[73] while this cannot be realized using traditional methods due to the difficulties in sample completeness.

Mathematical derivation of copula density function

[edit]For any two random variables X and Y, the continuous joint probability distribution function can be written as

where and are the marginal cumulative distribution functions of the random variables X and Y, respectively.

then the copula distribution function can be defined using Sklar's theorem[74][75] as:

where and are marginal distribution functions, joint and .

Assuming is a.e. twice differentiable, we start by using the relationship between joint probability density function (PDF) and joint cumulative distribution function (CDF) and its partial derivatives.

where is the copula density function, and are the marginal probability density functions of X and Y, respectively. There are four elements in this equation, and if any three elements are known, the fourth element can be calculated. For example, it may be used,

- when joint probability density function between two random variables is known, the copula density function is known, and one of the two marginal functions are known, then, the other marginal function can be calculated, or

- when the two marginal functions and the copula density function are known, then the joint probability density function between the two random variables can be calculated, or

- when the two marginal functions and the joint probability density function between the two random variables are known, then the copula density function can be calculated.

List of copula density functions and applications

[edit]Various bivariate copula density functions are important in the area of signal processing. and are marginal distributions functions and and are marginal density functions. Extension and generalization of copulas for statistical signal processing have been shown to construct new bivariate copulas for exponential, Weibull, and Rician distributions.[76] Zeng et al.[77] presented algorithms, simulation, optimal selection, and practical applications of these copulas in signal processing.

| Copula density: c(u, v) | Use | |

|---|---|---|

| Gaussian | supervised classification of synthetic aperture radar (SAR) images,[78]

validating biometric authentication,[79] modeling stochastic dependence in large-scale integration of wind power,[80] unsupervised classification of radar signals[81] | |

| Exponential | queuing system with infinitely many servers[82] | |

| Rayleigh | bivariate exponential, Rayleigh, and Weibull copulas have been proved to be equivalent[83][84][85] | change detection from SAR images[86] |

| Weibull | bivariate exponential, Rayleigh, and Weibull copulas have been proved to be equivalent[83][84][85] | digital communication over fading channels[87] |

| Log-normal | bivariate log-normal copula and Gaussian copula are equivalent[85][84] | shadow fading along with multipath effect in wireless channel[88][89] |

| Farlie–Gumbel–Morgenstern (FGM) | information processing of uncertainty in knowledge-based systems[90] | |

| Clayton | location estimation of random signal source and hypothesis testing using heterogeneous data[91][92] | |

| Frank | quantitative risk assessment of geo-hazards[93] | |

| Student's t | supervised SAR image classification,[86]

fusion of correlated sensor decisions[94] | |

| Nakagami-m | ||

| Rician |

See also

[edit]References

[edit]- ^ Thorsten Schmidt (2006) "Coping with Copulas", https://web.archive.org/web/20100705040514/http://www.tu-chemnitz.de/mathematik/fima/publikationen/TSchmidt_Copulas.pdf

- ^ a b Low, R.K.Y.; Alcock, J.; Faff, R.; Brailsford, T. (2013). "Canonical vine copulas in the context of modern portfolio management: Are they worth it?". Journal of Banking & Finance. 37 (8): 3085–3099. doi:10.1016/j.jbankfin.2013.02.036. S2CID 154138333.

- ^ a b Low, R.K.Y.; Faff, R.; Aas, K. (2016). "Enhancing mean–variance portfolio selection by modeling distributional asymmetries" (PDF). Journal of Economics and Business. 85: 49–72. doi:10.1016/j.jeconbus.2016.01.003.

- ^ Nelsen, Roger B. (1999), An Introduction to Copulas, New York: Springer, ISBN 978-0-387-98623-4

- ^ Sklar, A. (1959), "Fonctions de répartition à n dimensions et leurs marges", Publ. Inst. Statist. Univ. Paris, 8: 229–231

- ^ Durante, Fabrizio; Fernández-Sánchez, Juan; Sempi, Carlo (2013), "A Topological Proof of Sklar's Theorem", Applied Mathematics Letters, 26 (9): 945–948, doi:10.1016/j.aml.2013.04.005

- ^ Sadegh, Mojtaba; Ragno, Elisa; AghaKouchak, Amir (2017). "Multivariate Copula Analysis Toolbox (MvCAT): Describing dependence and underlying uncertainty using a Bayesian framework". Water Resources Research. 53 (6): 5166–5183. Bibcode:2017WRR....53.5166S. doi:10.1002/2016WR020242. ISSN 1944-7973.

- ^ AghaKouchak, Amir; Bárdossy, András; Habib, Emad (2010). "Copula-based uncertainty modelling: application to multisensor precipitation estimates". Hydrological Processes. 24 (15): 2111–2124. Bibcode:2010HyPr...24.2111A. doi:10.1002/hyp.7632. ISSN 1099-1085. S2CID 12283329.

- ^ a b Tootoonchi, Faranak; Haerter, Jan Olaf; Räty, Olle; Grabs, Thomas; Sadegh, Mojtaba; Teutschbein, Claudia (2020-07-21). "Copulas for hydroclimatic applications – A practical note on common misconceptions and pitfalls". Hydrology and Earth System Sciences Discussions: 1–31. doi:10.5194/hess-2020-306. ISSN 1027-5606. S2CID 224352645.

- ^ J. J. O'Connor and E. F. Robertson (March 2011). "Biography of Wassily Hoeffding". School of Mathematics and Statistics, University of St Andrews, Scotland. Retrieved 14 February 2019.

- ^ Botev, Z. I. (2016). "The normal law under linear restrictions: simulation and estimation via minimax tilting". Journal of the Royal Statistical Society, Series B. 79: 125–148. arXiv:1603.04166. Bibcode:2016arXiv160304166B. doi:10.1111/rssb.12162. S2CID 88515228.

- ^ Botev, Zdravko I. (10 November 2015). "TruncatedNormal: Truncated Multivariate Normal" – via R-Packages.

- ^ Arbenz, Philipp (2013). "Bayesian Copulae Distributions, with Application to Operational Risk Management—Some Comments". Methodology and Computing in Applied Probability. 15 (1): 105–108. doi:10.1007/s11009-011-9224-0. hdl:20.500.11850/64244. S2CID 121861059.

- ^ a b Nelsen, R. B. (2006). An Introduction to Copulas (Second ed.). New York: Springer. ISBN 978-1-4419-2109-3.

- ^ McNeil, A. J.; Nešlehová, J. (2009). "Multivariate Archimedean copulas, d-monotone functions and 1-norm symmetric distributions". Annals of Statistics. 37 (5b): 3059–3097. arXiv:0908.3750. doi:10.1214/07-AOS556. S2CID 9858856.

- ^ Ali, M. M.; Mikhail, N. N.; Haq, M. S. (1978), "A class of bivariate distributions including the bivariate logistic", J. Multivariate Anal., 8 (3): 405–412, doi:10.1016/0047-259X(78)90063-5

- ^ Clayton, David G. (1978). "A model for association in bivariate life tables and its application in epidemiological studies of familial tendency in chronic disease incidence". Biometrika. 65 (1): 141–151. doi:10.1093/biomet/65.1.141. JSTOR 2335289.

- ^ Alexander J. McNeil, Rudiger Frey and Paul Embrechts (2005) "Quantitative Risk Management: Concepts, Techniques, and Tools", Princeton Series in Finance

- ^ Nelsen, Roger B. (2006). An introduction to copulas (2nd ed.). New York: Springer. p. 220. ISBN 978-0-387-28678-5.

- ^ a b Low, Rand (2017-05-11). "Vine copulas: modelling systemic risk and enhancing higher-moment portfolio optimisation". Accounting & Finance. 58: 423–463. doi:10.1111/acfi.12274.

- ^ Rad, Hossein; Low, Rand Kwong Yew; Faff, Robert (2016-04-27). "The profitability of pairs trading strategies: distance, cointegration and copula methods". Quantitative Finance. 16 (10): 1541–1558. doi:10.1080/14697688.2016.1164337. S2CID 219717488.

- ^ Longin, F; Solnik, B (2001), "Extreme correlation of international equity markets", Journal of Finance, 56 (2): 649–676, CiteSeerX 10.1.1.321.4899, doi:10.1111/0022-1082.00340, S2CID 6143150

- ^ Ang, A; Chen, J (2002), "Asymmetric correlations of equity portfolios", Journal of Financial Economics, 63 (3): 443–494, doi:10.1016/s0304-405x(02)00068-5

- ^ Salmon, Felix. "Recipe for Disaster: The Formula That Killed Wall Street". Wired. ISSN 1059-1028. Retrieved 2023-08-11.

- ^ MacKenzie, Donald; Spears, Taylor (2014). "'The formula that killed Wall Street': The Gaussian copula and modelling practices in investment banking". Social Studies of Science. 44 (3): 393–417. doi:10.1177/0306312713517157. hdl:20.500.11820/3095760a-6d7c-4829-b327-98c9c28c1db6. ISSN 0306-3127. JSTOR 43284238. PMID 25051588. S2CID 15907952.

- ^ Cooke, R.M.; Joe, H.; Aas, K. (January 2011). Kurowicka, D.; Joe, H. (eds.). Dependence Modeling Vine Copula Handbook (PDF). World Scientific. pp. 37–72. ISBN 978-981-4299-87-9.

- ^ Aas, K; Czado, C; Bakken, H (2009), "Pair-copula constructions of multiple dependence", Insurance: Mathematics and Economics, 44 (2): 182–198, CiteSeerX 10.1.1.61.3984, doi:10.1016/j.insmatheco.2007.02.001, S2CID 18320750

- ^ a b c Low, R; Alcock, J; Brailsford, T; Faff, R (2013), "Canonical vine copulas in the context of modern portfolio management: Are they worth it?", Journal of Banking and Finance, 37 (8): 3085–3099, doi:10.1016/j.jbankfin.2013.02.036, S2CID 154138333

- ^ Meucci, Attilio (2011), "A New Breed of Copulas for Risk and Portfolio Management", Risk, 24 (9): 122–126

- ^ Meneguzzo, David; Vecchiato, Walter (Nov 2003), "Copula sensitivity in collateralized debt obligations and basket default swaps", Journal of Futures Markets, 24 (1): 37–70, doi:10.1002/fut.10110

- ^ Recipe for Disaster: The Formula That Killed Wall Street Wired, 2/23/2009

- ^ MacKenzie, Donald (2008), "End-of-the-World Trade", London Review of Books (published 2008-05-08), pp. 24–26, retrieved 2009-07-27

- ^ Jones, Sam (April 24, 2009), "The formula that felled Wall St", Financial Times, archived from the original on 2022-12-11, retrieved 2010-05-05

- ^ a b Lipton, Alexander; Rennie, Andrew (2008). Credit Correlation: Life After Copulas. World Scientific. ISBN 978-981-270-949-3.

- ^ Donnelly, C; Embrechts, P (2010). "The devil is in the tails: actuarial mathematics and the subprime mortgage crisis". ASTIN Bulletin. 40 (1): 1–33. doi:10.2143/AST.40.1.2049222. hdl:20.500.11850/20517.

- ^ Brigo, D; Pallavicini, A; Torresetti, R (2010). Credit Models and the Crisis: A Journey into CDOs, Copulas, Correlations and dynamic Models. Wiley and Sons.

- ^ Qu, Dong (2001). "Basket Implied Volatility Surface". Derivatives Week (4 June).

- ^ Qu, Dong (2005). "Pricing Basket Options With Skew". Wilmott Magazine (July).

- ^ Thompson, David; Kilgore, Roger (2011), "Estimating Joint Flow Probabilities at Stream Confluences using Copulas", Transportation Research Record, 2262: 200–206, doi:10.3141/2262-20, S2CID 17179491, retrieved 2012-02-21

- ^ Yang, S.C.; Liu, T.J.; Hong, H.P. (2017). "Reliability of Tower and Tower-Line Systems under Spatiotemporally Varying Wind or Earthquake Loads". Journal of Structural Engineering. 143 (10): 04017137. doi:10.1061/(ASCE)ST.1943-541X.0001835.

- ^ Zhang, Yi; Beer, Michael; Quek, Ser Tong (2015-07-01). "Long-term performance assessment and design of offshore structures". Computers & Structures. 154: 101–115. doi:10.1016/j.compstruc.2015.02.029.

- ^ Pham, Hong (2003), Handbook of Reliability Engineering, Springer, pp. 150–151

- ^ Wu, S. (2014), "Construction of asymmetric copulas and its application in two-dimensional reliability modelling" (PDF), European Journal of Operational Research, 238 (2): 476–485, doi:10.1016/j.ejor.2014.03.016, S2CID 22916401

- ^ Ruan, S.; Swaminathan, N; Darbyshire, O (2014), "Modelling of turbulent lifted jet flames using flamelets: a priori assessment and a posteriori validation", Combustion Theory and Modelling, 18 (2): 295–329, Bibcode:2014CTM....18..295R, doi:10.1080/13647830.2014.898409, S2CID 53641133

- ^ Darbyshire, O.R.; Swaminathan, N (2012), "A presumed joint pdf model for turbulent combustion with varying equivalence ratio", Combustion Science and Technology, 184 (12): 2036–2067, doi:10.1080/00102202.2012.696566, S2CID 98096093

- ^ Lapuyade-Lahorgue, Jerome; Xue, Jing-Hao; Ruan, Su (July 2017). "Segmenting Multi-Source Images Using Hidden Markov Fields With Copula-Based Multivariate Statistical Distributions". IEEE Transactions on Image Processing. 26 (7): 3187–3195. Bibcode:2017ITIP...26.3187L. doi:10.1109/tip.2017.2685345. ISSN 1057-7149. PMID 28333631. S2CID 11762408.

- ^ Zhang, Aiying; Fang, Jian; Calhoun, Vince D.; Wang, Yu-ping (April 2018). "High dimensional latent Gaussian copula model for mixed data in imaging genetics". 2018 IEEE 15th International Symposium on Biomedical Imaging (ISBI 2018). IEEE. pp. 105–109. doi:10.1109/isbi.2018.8363533. ISBN 978-1-5386-3636-7. S2CID 44114562.

- ^ Bahrami, Mohsen; Hossein-Zadeh, Gholam-Ali (May 2015). "Assortativity changes in Alzheimer's diesease: A resting-state FMRI study". 2015 23rd Iranian Conference on Electrical Engineering. IEEE. pp. 141–144. doi:10.1109/iraniancee.2015.7146198. ISBN 978-1-4799-1972-7. S2CID 20649428.

- ^ Qian, Dong; Wang, Bei; Qing, Xiangyun; Zhang, Tao; Zhang, Yu; Wang, Xingyu; Nakamura, Masatoshi (April 2017). "Drowsiness Detection by Bayesian-Copula Discriminant Classifier Based on EEG Signals During Daytime Short Nap". IEEE Transactions on Biomedical Engineering. 64 (4): 743–754. doi:10.1109/tbme.2016.2574812. ISSN 0018-9294. PMID 27254855. S2CID 24244444.

- ^ Yoshida, Hisashi; Kuramoto, Haruka; Sunada, Yusuke; Kikkawa, Sho (August 2007). "EEG Analysis in Wakefulness Maintenance State against Sleepiness by Instantaneous Equivalent Bandwidths". 2007 29th Annual International Conference of the IEEE Engineering in Medicine and Biology Society. Vol. 2007. IEEE. pp. 19–22. doi:10.1109/iembs.2007.4352212. ISBN 978-1-4244-0787-3. PMID 18001878. S2CID 29527332.

- ^ Iyengar, Satish G.; Dauwels, Justin; Varshney, Pramod K.; Cichocki, Andrzej (2010). "Quantifying EEG synchrony using copulas". 2010 IEEE International Conference on Acoustics, Speech and Signal Processing. IEEE. pp. 505–508. doi:10.1109/icassp.2010.5495664. ISBN 978-1-4244-4295-9. S2CID 16476449.

- ^ Gao, Xu; Shen, Weining; Ting, Chee-Ming; Cramer, Steven C.; Srinivasan, Ramesh; Ombao, Hernando (April 2019). "Estimating Brain Connectivity Using Copula Gaussian Graphical Models". 2019 IEEE 16th International Symposium on Biomedical Imaging (ISBI 2019). IEEE. pp. 108–112. doi:10.1109/isbi.2019.8759538. ISBN 978-1-5386-3641-1. S2CID 195881851.

- ^ Fadlallah, B. H.; Brockmeier, A. J.; Seth, S.; Lin Li; Keil, A.; Principe, J. C. (August 2012). "An Association Framework to Analyze Dependence Structure in Time Series". 2012 Annual International Conference of the IEEE Engineering in Medicine and Biology Society. Vol. 2012. IEEE. pp. 6176–6179. doi:10.1109/embc.2012.6347404. ISBN 978-1-4577-1787-1. PMID 23367339. S2CID 9061806.

- ^ Eban, E; Rothschild, R; Mizrahi, A; Nelken, I; Elidan, G (2013), Carvalho, C; Ravikumar, P (eds.), "Dynamic Copula Networks for Modeling Real-valued Time Series" (PDF), Journal of Machine Learning Research, 31

- ^ Onken, A; Grünewälder, S; Munk, MH; Obermayer, K (2009), Aertsen, Ad (ed.), "Analyzing Short-Term Noise Dependencies of Spike-Counts in Macaque Prefrontal Cortex Using Copulas and the Flashlight Transformation", PLOS Computational Biology, 5 (11): e1000577, Bibcode:2009PLSCB...5E0577O, doi:10.1371/journal.pcbi.1000577, PMC 2776173, PMID 19956759

- ^ Bao, Le; Zhu, Zhou; Ye, Jingjing (March 2009). "Modeling oncology gene pathways network with multiple genotypes and phenotypes via a copula method". 2009 IEEE Symposium on Computational Intelligence in Bioinformatics and Computational Biology. IEEE. pp. 237–246. doi:10.1109/cibcb.2009.4925734. ISBN 978-1-4244-2756-7. S2CID 16779505.

- ^ Kwitt, Roland; Uhl, Andreas; Hafner, Michael; Gangl, Alfred; Wrba, Friedrich; Vecsei, Andreas (June 2010). "Predicting the histology of colorectal lesions in a probabilistic framework". 2010 IEEE Computer Society Conference on Computer Vision and Pattern Recognition - Workshops. IEEE. pp. 103–110. doi:10.1109/cvprw.2010.5543146. ISBN 978-1-4244-7029-7. S2CID 14841548.

- ^ Kon, M. A.; Nikolaev, N. (December 2011). "Empirical Normalization for Quadratic Discriminant Analysis and Classifying Cancer Subtypes". 2011 10th International Conference on Machine Learning and Applications and Workshops. IEEE. pp. 374–379. arXiv:1203.6345. doi:10.1109/icmla.2011.160. hdl:2144/38445. ISBN 978-1-4577-2134-2. S2CID 346934.

- ^ Namazi, Asieh (December 2022). "On the improvement of heart rate prediction using the combination of singular spectrum analysis and copula-based analysis approach". PeerJ. 10: e14601. doi:10.7717/peerj.14601. ISSN 2167-8359. PMC 9774013. PMID 36570014.

- ^ Modiri, S.; Belda, S.; Heinkelmann, R.; Hoseini, M.; Ferrándiz, J.M.; Schuh, H. (2018). "Polar motion prediction using the combination of SSA and Copula-based analysis". Earth, Planets and Space. 70 (70): 115. Bibcode:2018EP&S...70..115M. doi:10.1186/s40623-018-0888-3. PMC 6434970. PMID 30996648.

- ^ Modiri, S.; Belda, S.; Hoseini, M.; Heinkelmann, R.; Ferrándiz, J.M.; Schuh, H. (2020). "A new hybrid method to improve the ultra-short-term prediction of LOD". Journal of Geodesy. 94 (23): 23. Bibcode:2020JGeod..94...23M. doi:10.1007/s00190-020-01354-y. PMC 7004433. PMID 32109976.

- ^ Lazoglou, Georgia; Anagnostopoulou, Christina (February 2019). "Joint distribution of temperature and precipitation in the Mediterranean, using the Copula method". Theoretical and Applied Climatology. 135 (3–4): 1399–1411. Bibcode:2019ThApC.135.1399L. doi:10.1007/s00704-018-2447-z. ISSN 0177-798X. S2CID 125268690.

- ^ Cong, Rong-Gang; Brady, Mark (2012). "The Interdependence between Rainfall and Temperature: Copula Analyses". The Scientific World Journal. 2012: 405675. doi:10.1100/2012/405675. ISSN 1537-744X. PMC 3504421. PMID 23213286.

- ^ Wang, Long; Yu, Hang; Yang, Maoling; Yang, Rui; Gao, Rui; Wang, Ying (April 2019). "A drought index: The standardized precipitation evapotranspiration runoff index". Journal of Hydrology. 571: 651–668. Bibcode:2019JHyd..571..651W. doi:10.1016/j.jhydrol.2019.02.023. S2CID 134409125.

- ^ Alidoost, Fakhereh; Su, Zhongbo; Stein, Alfred (December 2019). "Evaluating the effects of climate extremes on crop yield, production and price using multivariate distributions: A new copula application". Weather and Climate Extremes. 26: 100227. Bibcode:2019WCE....2600227A. doi:10.1016/j.wace.2019.100227.

- ^ Schölzel, C.; Friederichs, P. (2008). "Multivariate non-normally distributed random variables in climate research – introduction to the copula approach". Nonlinear Processes in Geophysics. 15 (5): 761–772. Bibcode:2008NPGeo..15..761S. doi:10.5194/npg-15-761-2008.

- ^ Laux, P.; Vogl, S.; Qiu, W.; Knoche, H.R.; Kunstmann, H. (2011). "Copula-based statistical refinement of precipitation in RCM simulations over complex terrain". Hydrol. Earth Syst. Sci. 15 (7): 2401–2419. Bibcode:2011HESS...15.2401L. doi:10.5194/hess-15-2401-2011.

- ^ Munkhammar, J.; Widén, J. (2017). "A copula method for simulating correlated instantaneous solar irradiance in spatial networks". Solar Energy. 143: 10–21. Bibcode:2017SoEn..143...10M. doi:10.1016/j.solener.2016.12.022.

- ^ Munkhammar, J.; Widén, J. (2017). "An autocorrelation-based copula model for generating realistic clear-sky index time-series". Solar Energy. 158: 9–19. Bibcode:2017SoEn..158....9M. doi:10.1016/j.solener.2017.09.028.

- ^ Strelen, Johann Christoph (2009). Tools for Dependent Simulation Input with Copulas. 2nd International ICST Conference on Simulation Tools and Techniques. doi:10.4108/icst.simutools2009.5596.

- ^ Bandara, H. M. N. D.; Jayasumana, A. P. (Dec 2011). "On Characteristics and Modeling of P2P Resources with Correlated Static and Dynamic Attributes". 2011 IEEE Global Telecommunications Conference - GLOBECOM 2011. IEEE Globecom. pp. 1–6. CiteSeerX 10.1.1.309.3975. doi:10.1109/GLOCOM.2011.6134288. ISBN 978-1-4244-9268-8. S2CID 7135860.

- ^ Mileva Boshkoska, Biljana; Bohanec, Marko; Boškoski, Pavle; Juričić, Ðani (2015-04-01). "Copula-based decision support system for quality ranking in the manufacturing of electronically commutated motors". Journal of Intelligent Manufacturing. 26 (2): 281–293. doi:10.1007/s10845-013-0781-7. ISSN 1572-8145. S2CID 982081.

- ^ Zunli, Yuan; Jiancheng, Wang; Diana, Worrall; Bin-Bin, Zhang; Jirong, Mao (2018). "Determining the Core Radio Luminosity Function of Radio AGNs via Copula". The Astrophysical Journal Supplement Series. 239 (2): 33. arXiv:1810.12713. Bibcode:2018ApJS..239...33Y. doi:10.3847/1538-4365/aaed3b. S2CID 59330508.

- ^ Appell, Paul; Goursat, Edouard (1895). Théorie des fonctions algébriques et de leurs intégrales étude des fonctions analytiques sur une surface de Riemann / par Paul Appell, Édouard Goursat. Paris: Gauthier-Villars. doi:10.5962/bhl.title.18731.

- ^ Durante, Fabrizio; Fernández-Sánchez, Juan; Sempi, Carlo (2013). "A topological proof of Sklar's theorem". Applied Mathematics Letters. 26 (9): 945–948. doi:10.1016/j.aml.2013.04.005. ISSN 0893-9659.

- ^ Zeng, Xuexing; Ren, Jinchang; Wang, Zheng; Marshall, Stephen; Durrani, Tariq (January 2014). "Copulas for statistical signal processing (Part I): Extensions and generalization" (PDF). Signal Processing. 94: 691–702. Bibcode:2014SigPr..94..691Z. doi:10.1016/j.sigpro.2013.07.009. ISSN 0165-1684.

- ^ Zeng, Xuexing; Ren, Jinchang; Sun, Meijun; Marshall, Stephen; Durrani, Tariq (January 2014). "Copulas for statistical signal processing (Part II): Simulation, optimal selection and practical applications" (PDF). Signal Processing. 94: 681–690. Bibcode:2014SigPr..94..681Z. doi:10.1016/j.sigpro.2013.07.006. ISSN 0165-1684.

- ^ Storvik, B.; Storvik, G.; Fjortoft, R. (2009). "On the Combination of Multisensor Data Using Meta-Gaussian Distributions". IEEE Transactions on Geoscience and Remote Sensing. 47 (7): 2372–2379. Bibcode:2009ITGRS..47.2372S. doi:10.1109/tgrs.2009.2012699. ISSN 0196-2892. S2CID 371395.

- ^ Dass, S.C.; Yongfang Zhu; Jain, A.K. (2006). "Validating a Biometric Authentication System: Sample Size Requirements". IEEE Transactions on Pattern Analysis and Machine Intelligence. 28 (12): 1902–1319. doi:10.1109/tpami.2006.255. ISSN 0162-8828. PMID 17108366. S2CID 1272268.

- ^ Papaefthymiou, G.; Kurowicka, D. (2009). "Using Copulas for Modeling Stochastic Dependence in Power System Uncertainty Analysis". IEEE Transactions on Power Systems. 24 (1): 40–49. Bibcode:2009ITPSy..24...40P. doi:10.1109/tpwrs.2008.2004728. ISSN 0885-8950.

- ^ Brunel, N.J.-B.; Lapuyade-Lahorgue, J.; Pieczynski, W. (2010). "Modeling and Unsupervised Classification of Multivariate Hidden Markov Chains With Copulas". IEEE Transactions on Automatic Control. 55 (2): 338–349. doi:10.1109/tac.2009.2034929. ISSN 0018-9286. S2CID 941655.

- ^ Lai, Chin Diew; Balakrishnan, N. (2009). Continuous Bivariate Distributions. doi:10.1007/b101765. ISBN 978-0-387-09613-1.

- ^ a b Durrani, T.S.; Zeng, X. (2007). "Copulas for bivariate probability distributions". Electronics Letters. 43 (4): 248. Bibcode:2007ElL....43..248D. doi:10.1049/el:20073737. ISSN 0013-5194.

- ^ a b c Liu, X. (2010). "Copulas of bivariate Rayleigh and log-normal distributions". Electronics Letters. 46 (25): 1669–1671. Bibcode:2010ElL....46.1669L. doi:10.1049/el.2010.2777. ISSN 0013-5194.

- ^ a b c Zeng, Xuexing; Ren, Jinchang; Wang, Zheng; Marshall, Stephen; Durrani, Tariq (2014). "Copulas for statistical signal processing (Part I): Extensions and generalization" (PDF). Signal Processing. 94: 691–702. Bibcode:2014SigPr..94..691Z. doi:10.1016/j.sigpro.2013.07.009. ISSN 0165-1684.

- ^ a b Hachicha, S.; Chaabene, F. (2010). Frouin, Robert J; Yoo, Hong Rhyong; Won, Joong-Sun; Feng, Aiping (eds.). "SAR change detection using Rayleigh copula". Remote Sensing of the Coastal Ocean, Land, and Atmosphere Environment. 7858. SPIE: 78581F. Bibcode:2010SPIE.7858E..1FH. doi:10.1117/12.870023. S2CID 129437866.

- ^ "Coded Communication over Fading Channels", Digital Communication over Fading Channels, John Wiley & Sons, Inc., pp. 758–795, 2005, doi:10.1002/0471715220.ch13, ISBN 978-0-471-71522-1

- ^ Das, Saikat; Bhattacharya, Amitabha (2020). "Application of the Mixture of Lognormal Distribution to Represent the First-Order Statistics of Wireless Channels". IEEE Systems Journal. 14 (3): 4394–4401. Bibcode:2020ISysJ..14.4394D. doi:10.1109/JSYST.2020.2968409. ISSN 1932-8184. S2CID 213729677.

- ^ Alouini, M.-S.; Simon, M.K. (2002). "Dual diversity over correlated log-normal fading channels". IEEE Transactions on Communications. 50 (12): 1946–1959. doi:10.1109/TCOMM.2002.806552. ISSN 0090-6778.

- ^ Kolesárová, Anna; Mesiar, Radko; Saminger-Platz, Susanne (2018), Medina, Jesús; Ojeda-Aciego, Manuel; Verdegay, José Luis; Pelta, David A. (eds.), "Generalized Farlie-Gumbel-Morgenstern Copulas", Information Processing and Management of Uncertainty in Knowledge-Based Systems. Theory and Foundations, Communications in Computer and Information Science, vol. 853, Springer International Publishing, pp. 244–252, doi:10.1007/978-3-319-91473-2_21, ISBN 978-3-319-91472-5

- ^ Sundaresan, Ashok; Varshney, Pramod K. (2011). "Location Estimation of a Random Signal Source Based on Correlated Sensor Observations". IEEE Transactions on Signal Processing. 59 (2): 787–799. Bibcode:2011ITSP...59..787S. doi:10.1109/tsp.2010.2084084. ISSN 1053-587X. S2CID 5725233.

- ^ Iyengar, Satish G.; Varshney, Pramod K.; Damarla, Thyagaraju (2011). "A Parametric Copula-Based Framework for Hypothesis Testing Using Heterogeneous Data". IEEE Transactions on Signal Processing. 59 (5): 2308–2319. Bibcode:2011ITSP...59.2308I. doi:10.1109/tsp.2011.2105483. ISSN 1053-587X. S2CID 5549193.

- ^ Liu, Xin; Wang, Yu (2023). "Analytical solutions for annual probability of slope failure induced by rainfall at a specific slope using bivariate distribution of rainfall intensity and duration". Engineering Geology. 313: 106969. Bibcode:2023EngGe.31306969L. doi:10.1016/j.enggeo.2022.106969. ISSN 1872-6917. S2CID 254807263.

- ^ Sundaresan, Ashok; Varshney, Pramod K.; Rao, Nageswara S. V. (2011). "Copula-Based Fusion of Correlated Decisions". IEEE Transactions on Aerospace and Electronic Systems. 47 (1): 454–471. Bibcode:2011ITAES..47..454S. doi:10.1109/taes.2011.5705686. ISSN 0018-9251. S2CID 22562771.

Further reading

[edit]- The standard reference for an introduction to copulas. Covers all fundamental aspects, summarizes the most popular copula classes, and provides proofs for the important theorems related to copulas

- Roger B. Nelsen (1999), "An Introduction to Copulas", Springer. ISBN 978-0-387-98623-4

- A book covering current topics in mathematical research on copulas:

- Piotr Jaworski, Fabrizio Durante, Wolfgang Karl Härdle, Tomasz Rychlik (Editors): (2010): "Copula Theory and Its Applications" Lecture Notes in Statistics, Springer. ISBN 978-3-642-12464-8

- A reference for sampling applications and stochastic models related to copulas is

- Jan-Frederik Mai, Matthias Scherer (2012): Simulating Copulas (Stochastic Models, Sampling Algorithms and Applications). World Scientific. ISBN 978-1-84816-874-9

- A paper covering the historic development of copula theory, by the person associated with the "invention" of copulas, Abe Sklar.

- Abe Sklar (1997): "Random variables, distribution functions, and copulas – a personal look backward and forward" in Rüschendorf, L., Schweizer, B. und Taylor, M. (eds) Distributions With Fixed Marginals & Related Topics (Lecture Notes – Monograph Series Number 28). ISBN 978-0-940600-40-9

- The standard reference for multivariate models and copula theory in the context of financial and insurance models

- Alexander J. McNeil, Rudiger Frey and Paul Embrechts (2005) "Quantitative Risk Management: Concepts, Techniques, and Tools", Princeton Series in Finance. ISBN 978-0-691-12255-7

External links

[edit]- "Copula", Encyclopedia of Mathematics, EMS Press, 2001 [1994]

- Copula Wiki: community portal for researchers with interest in copulas Archived 2016-09-11 at the Wayback Machine

- A collection of Copula simulation and estimation codes

- Copulas & Correlation using Excel Simulation Articles

- Chapter 1 of Jan-Frederik Mai, Matthias Scherer (2012) "Simulating Copulas: Stochastic Models, Sampling Algorithms, and Applications"

![{\displaystyle F_{i}(x)=\Pr[X_{i}\leq x]}](https://wikimedia.org/api/rest_v1/media/math/render/svg/2980e5dcb25467ed9d2238ba1990c9aff7ca8b5c)

![{\displaystyle C(u_{1},u_{2},\dots ,u_{d})=\Pr[U_{1}\leq u_{1},U_{2}\leq u_{2},\dots ,U_{d}\leq u_{d}].}](https://wikimedia.org/api/rest_v1/media/math/render/svg/9a94a2eeb84fc83baad8a1e819ff4f8b46b9fd07)

![{\displaystyle C(u_{1},u_{2},\dots ,u_{d})=\Pr[X_{1}\leq F_{1}^{-1}(u_{1}),X_{2}\leq F_{2}^{-1}(u_{2}),\dots ,X_{d}\leq F_{d}^{-1}(u_{d})].}](https://wikimedia.org/api/rest_v1/media/math/render/svg/01a3e0330faabf83d10247540cabac352edd1f5a)

![{\displaystyle C:[0,1]^{d}\rightarrow [0,1]}](https://wikimedia.org/api/rest_v1/media/math/render/svg/40af55f356a2e5d65a93019852c1c5e0cbf07625)

![{\displaystyle [0,1]^{d}}](https://wikimedia.org/api/rest_v1/media/math/render/svg/e13ae4917276744b214714a20b3cb8ee305e309d)

![{\displaystyle B=\prod _{i=1}^{d}[x_{i},y_{i}]\subseteq [0,1]^{d}}](https://wikimedia.org/api/rest_v1/media/math/render/svg/351f96aa29a3d1851e3bbc80c6348449ffe0746c)

![{\displaystyle C:[0,1]\times [0,1]\rightarrow [0,1]}](https://wikimedia.org/api/rest_v1/media/math/render/svg/f271c6025d698ce8ebf1078044d193b1a5587a94)

![{\displaystyle H(x_{1},\dots ,x_{d})=\Pr[X_{1}\leq x_{1},\dots ,X_{d}\leq x_{d}]}](https://wikimedia.org/api/rest_v1/media/math/render/svg/2b6e179e9bd5d86f303c58ae8fef0e67155ddbce)

![{\displaystyle F_{i}(x_{i})=\Pr[X_{i}\leq x_{i}]}](https://wikimedia.org/api/rest_v1/media/math/render/svg/787d08554a01e4fc5b4100e85eb73e3137cf5cf1)

![{\displaystyle (u_{1},\dots ,u_{d})\in [0,1]^{d}}](https://wikimedia.org/api/rest_v1/media/math/render/svg/f357cb50ea6b8e6f47f4f470b5436fa090f658c6)

![{\displaystyle R\in [-1,1]^{d\times d}}](https://wikimedia.org/api/rest_v1/media/math/render/svg/1a071e34a31e85adcd94121469d8f270035b2eaf)

![{\displaystyle \psi \!:[0,1]\times \Theta \rightarrow [0,\infty )}](https://wikimedia.org/api/rest_v1/media/math/render/svg/72604f5871b27926c148bace5587ddf8d8c16946)

![{\displaystyle \theta \in [-1,1]}](https://wikimedia.org/api/rest_v1/media/math/render/svg/5fcef395b022543b8655b81eaf82ecf028550abb)

![{\displaystyle \log \!\left[{\frac {1-\theta (1-t)}{t}}\right]}](https://wikimedia.org/api/rest_v1/media/math/render/svg/4cd29ebc997de95a338f66163136f5513152e4e3)

![{\displaystyle \left[\max \left\{u^{-\theta }+v^{-\theta }-1;0\right\}\right]^{-1/\theta }}](https://wikimedia.org/api/rest_v1/media/math/render/svg/7266b1df307368fd625b261caee57a2136bcd521)

![{\displaystyle -{\frac {1}{\theta }}\log \!\left[1+{\frac {(\exp(-\theta u)-1)(\exp(-\theta v)-1)}{\exp(-\theta )-1}}\right]}](https://wikimedia.org/api/rest_v1/media/math/render/svg/594e71d78f84f97fa19a76d57940d15fe68f998e)

![{\textstyle \exp \!\left[-\left((-\log(u))^{\theta }+(-\log(v))^{\theta }\right)^{1/\theta }\right]}](https://wikimedia.org/api/rest_v1/media/math/render/svg/739c3170ca7ea51fe7489b2e6248e8fe26768720)

![{\textstyle {1-\left[(1-u)^{\theta }+(1-v)^{\theta }-(1-u)^{\theta }(1-v)^{\theta }\right]^{1/\theta }}}](https://wikimedia.org/api/rest_v1/media/math/render/svg/c30e67e928a1c0940b7b030587d29affda291fc4)

![{\displaystyle \operatorname {E} \left[g(X_{1},\dots ,X_{d})\right]=\int _{\mathbb {R} ^{d}}g(x_{1},\dots ,x_{d})\,\mathrm {d} H(x_{1},\dots ,x_{d}).}](https://wikimedia.org/api/rest_v1/media/math/render/svg/d3b79232a4f8caba8f38d321679233824256d4d3)

![{\displaystyle \operatorname {E} \left[g(X_{1},\dots ,X_{d})\right]=\int _{[0,1]^{d}}g(F_{1}^{-1}(u_{1}),\dots ,F_{d}^{-1}(u_{d}))\,\mathrm {d} C(u_{1},\dots ,u_{d}).}](https://wikimedia.org/api/rest_v1/media/math/render/svg/926f937f6b5cdce4c11e058b18cf41ac585a0324)

![{\displaystyle \operatorname {E} \left[g(X_{1},\dots ,X_{d})\right]=\int _{[0,1]^{d}}g(F_{1}^{-1}(u_{1}),\dots ,F_{d}^{-1}(u_{d}))\cdot c(u_{1},\dots ,u_{d})\,du_{1}\cdots \mathrm {d} u_{d},}](https://wikimedia.org/api/rest_v1/media/math/render/svg/7e63d57530cb81f73691e124bbe7ef057a65b29e)

![{\displaystyle \operatorname {E} \left[g(X_{1},\dots ,X_{d})\right]=\int _{\mathbb {R} ^{d}}g(x_{1},\dots x_{d})\cdot c(F_{1}(x_{1}),\dots ,F_{d}(x_{d}))\cdot f_{1}(x_{1})\cdots f_{d}(x_{d})\,\mathrm {d} x_{1}\cdots \mathrm {d} x_{d}.}](https://wikimedia.org/api/rest_v1/media/math/render/svg/cea4d38bc3f0acf3b8a35a0db2922da06bd02fa9)

![{\displaystyle \operatorname {E} \left[g(X_{1},\dots ,X_{d})\right]}](https://wikimedia.org/api/rest_v1/media/math/render/svg/ba4b7e451d1c2f65485ec3b5f1469324bafacb52)

![{\displaystyle \operatorname {E} \left[g(X_{1},\dots ,X_{d})\right]\approx {\frac {1}{n}}\sum _{k=1}^{n}g(X_{1}^{k},\dots ,X_{d}^{k})}](https://wikimedia.org/api/rest_v1/media/math/render/svg/6f1c7564cfbe956cd4fe9d987b4a185270bb4914)

![{\displaystyle r={\frac {12}{n^{2}-1}}\sum _{i=1}^{n}\sum _{j=1}^{n}\left[C^{n}\left({\frac {i}{n}},{\frac {j}{n}}\right)-{\frac {i}{n}}\cdot {\frac {j}{n}}\right]}](https://wikimedia.org/api/rest_v1/media/math/render/svg/6acdcd7574b222e8d690683320d1b82b482b05e4)

![{\displaystyle {\begin{aligned}={}&1+\theta (1-2u)(1-2v)\\&{\text{where }}\theta \in [-1,1]\end{aligned}}}](https://wikimedia.org/api/rest_v1/media/math/render/svg/b30181c64bf603461998b09871a4969e8f86cad8)